Carrier Directives for Mobile Telephony Service Surcharge for 2018

February 26, 2019

***For directions regarding reporting periods starting January 2019, please refer to Surcharge Directive***

On November 16, 2018, the Northern District of California issued an Injunction Order (Joint Order Granting Plaintiff’s Motion for Summary Judgment, Denying Defendants’ Motion for Summary Judgment, and issuing Declaration and Permanent Injunction) that “enjoins the CPUC… from enforcing the Prepaid Collection Act…” after declaring the Act (MTS) to be preempted and unconstitutional. Resolution L-574 provides more details.

Due to this invalidation, effective January 1, 2019, intrastate prepaid wireless services that were subject to the Act are to be assessed the same Commission adopted surcharge and User Fee rates applicable to all other telecommunications services. Prepaid wireless carriers are responsible for collecting, reporting, and remitting surcharges and user fees due on all wireless services, including indirect sales of prepaid wireless services, consistent with existing state laws and Commission directives prior to the implementation of the MTS Act, which became effective January 1, 2016.

Starting February 1, 2019, the following changes are reflected on TUFFS:

- References to “MTS” will be removed and/or replaced with “Prepaid”

- Surcharges and User Fee rates will be the same across all carrier types and service types

- Revenue reported under “Indirect Intrastate Prepaid Wireless Revenues” will be assessed surcharges and the User Fee

Telecommunications carriers offering intrastate prepaid wireless services in California shall continue to report “Direct Intrastate Prepaid Wireless Revenues” and “Indirect Intrastate Prepaid Wireless Revenues” separately. Deadlines for the submission of surcharges and user fees remain unchanged.

Directions for the assessment, collection, reporting, remittance and record keeping of the new prepaid Mobile Telephony Services Surcharge by wireless telephone corporations (direct sellers) offering prepaid services.

"The Prepaid Mobile Telephony Services Surcharge Collection Act" (The Act) was enacted by Assembly Bill 1717, (Chapter 885, Statutes 2014, Perea).

The Act creates an entirely new point-of-sale mechanism for the collection and remittance of the taxes and fees assessed on prepaid wireless telephone service. The Act also aggregates the surcharges, taxes, and fees that are assessed on telephone services and creates the new prepaid MTS surcharge that is imposed on prepaid wireless telephone services in lieu of the individual fees.

- CPUC Public Purpose Program Surcharges

- CPUC User Fee

- Emergency Telephone Users (911) Surcharge and

- Local Utility User Taxes (UUT)

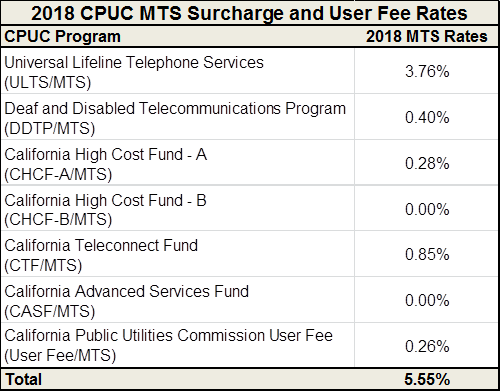

MTS surcharge rates will be posted annually between October 1st and October 8th and will be effective for the entirety of the following year. The current MTS surcharge rates are applied to any and all customers who purchase prepaid wireless telephone service in California from January 1, 2018, through December 31, 2018. The Act became effective January 1, 2016, and remains in effect until January 1, 2020.

The new MTS surcharge is assessed on prepaid wireless intrastate telephone services sold in California.

The Act does not apply to the sale of wireline, VOIP, post-paid wireless, or any other type of telecommunications services sold in California.

"Intrastate" means a telecommunications service that originates and terminates within California. Generally, services subject to tariff (or formerly tariffed) with the CPUC are subject to California surcharges, whereas Interstate services, taxes and surcharges, and financial charges and fees, are not. Intrastate wireless services that are subject to the MTS surcharges include, but are not limited to voice, text, and any associated services.

At the point of purchase, the current State MTS surcharge amount of 5.90% plus the applicable local Utility User Tax rate (reference: Prepaid Mobile Telephony Services (MTS) Surcharge Rates) is multiplied by the total sales price to arrive at the MTS surcharge amount due.

(CPUC + 911+UUT) x Total Sales Price = MTS Surcharge

- CPUC surcharges and user fee adopted in T-17579= 5.55%

- Emergency 9-1-1 surcharge= 0.75%

- Local Utility User Tax= 0%-9% (where applicable)

A single line item charge must then be displayed identifying the amount of the total MTS surcharge due.

Pursuant to Revenue and Taxation Code Section 42010(i)

How: the amount of the combined prepaid MTS surcharge and local charges shall be separately stated; on an invoice, receipt, or other similar document that is provided to the prepaid consumer of mobile telephony services by the seller, or otherwise disclosed electronically to the prepaid consumer;

When: …at the time of the retail transaction.

Further Clarification: We interpret this code to mean that disclosure of the prepaid MTS surcharge/taxes/fees by a prepaid wireless telephone corporation must occur at the time payment is received for any prepaid wireless service sold in California that is subject to the MTS surcharge. In other words, each purchase by the customer constitutes a prepaid mobile telephony service "retail transaction" because it is when the customer has paid in advance for the right to utilize a particular prepaid wireless service plan.

Assembly Bill 1717 (the Act) requires carriers to report direct prepaid wireless intrastate revenue subject to surcharge and remit the accompanying fees and to report total prepaid wireless service revenue. It also provides the Commission with authority to require any other reporting it determines is necessary.

Wireless carriers are required to report the following intrastate revenues:

- total non-prepaid wireless revenue

- total direct prepaid wireless revenue

- total indirect prepaid wireless revenue

Carriers are required to report and remit the surcharges and fees due for:

- non-prepaid wireless revenue

- direct prepaid wireless revenue

Carriers do not remit surcharges and fees on total indirect prepaid wireless revenue, but are still required to report the revenue to the CPUC.

The MTS surcharge is due to the CPUC in accordance with the existing CPUC surcharge and user fee reporting and remittance timeframes that apply to the six Public Purpose Programs and the CPUC User Fee.

In accordance with Commission Decision 98-01‐023 and General Order 153 (11.4), Public Purpose Program surcharge monies be reported and remitted no later than 40 days following the close of the reporting period.

The CPUC User Fee follows the schedule outlined in PUC Code Section 432, which requires quarterly reporting and remitting, by the 15th of April, July, October, and January.

Carriers that report and/or remit the surcharge after the due date will be assessed a penalty based on the existing penalties of the six Public Purpose Programs and the User Fee.

The Public Purpose Program portion of the MTS surcharge is subject to a penalty equal to an annual interest rate of 10%. The penalty is assessed on the surcharge amount due, including any adjustments, starting from the 41st day after the close of the reporting period.

The CPUC User Fee portion of the MTS surcharge is subject to a 25% penalty, assessed on the 46th day after the close of the reporting period.

Carriers are required to use the CPUC's Telecommunications and User Fee Filing System (TUFFS) to report and remit the portion of the MTS surcharge due to the Commission.

Instructions regarding how to use the online system to report and remit payments can be found in the TUFFS and EFT payment system user guides on the CPUC's website.