The Prepaid Mobile Telephony Services Surcharge Collection Act

Assembly Bill 1717

“On November 16, 2018, the Northern District of California issued an Injunction Order (Joint Order Granting Plaintiff’s Motion for Summary Judgment, Denying Defendants’ Motion for Summary Judgment, and issuing Declaration and Permanent Injunction) that “enjoins the CPUC… from enforcing the Prepaid Collection Act…” after declaring the Act (MTS) to be preempted and unconstitutional. Resolution L-574 provides more details.

Due to this invalidation, effective January 1, 2019, intrastate prepaid wireless services that were subject to the Act are to be assessed the same Commission adopted surcharge and User Fee rates applicable to all other telecommunications services. Prepaid wireless carriers are responsible for collecting, reporting, and remitting surcharges and user fees due on all wireless services, including indirect sales of prepaid wireless services, consistent with existing state laws and Commission directives prior to the implementation of the MTS Act, which became effective January 1, 2016.”

- “The Prepaid Mobile Telephony Services Surcharge Collection Act” (The Act) was enacted by Assembly Bill 1717, (Chapter 885, Statutes 2014, Perea).

- The Act creates an entirely new point-of-sale mechanism for the collection and remittance of the taxes and fees assessed on prepaid wireless telephone service.

- This new mechanism collects the following charges:

- Commission Public Purpose Program Surcharges,

- Commission User Fee,

- Emergency Telephone Users (911) Surcharge, and

- Local utility user taxes (UUT).

The Act aggregates the surcharges, taxes and fee listed above and creates the new prepaid Mobile Telephony Services (MTS) surcharge that is required to be imposed on prepaid wireless telephone services in lieu of the individual fees. The Act becomes effective January 1, 2016 and remains in effect until January 1, 2020.

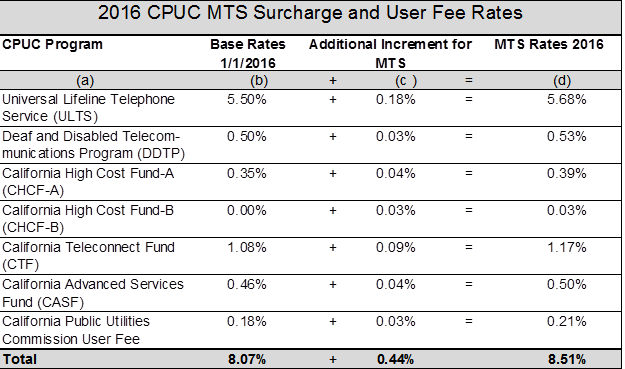

The Act directs the Commission to prepare a resolution, or other public document, to provide public notice of the proposed MTS rates and to adopt the proposed rates. In response to this requirement, this resolution provides the methodology and specific calculations used to arrive at the new prepaid MTS surcharge rates for 2016. The proposed rates are to be assessed on the sale of intrastate prepaid wireless telephone services in California.

Resolution T-17504. Mobile Telephony Services surcharge rates to be assessed on prepaid wireless telephone service for January 1, 2016.

Surcharge rates effective January 1, 2016 adopted per Resolution T-17504.

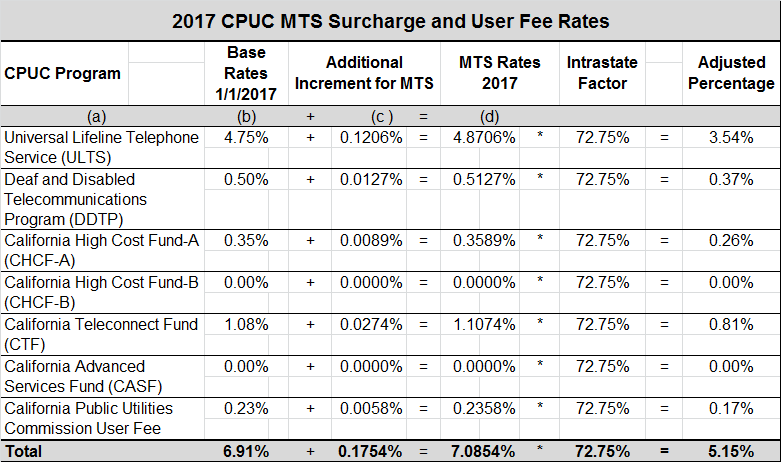

The current rates for January 1, 2016 to December 31, 2016 is 8.51%. Effective January 1, 2017 to December 31, 2017 the new Mobile Telephony Service Surcharge rate will be 5.15%. The following are the proposed 2017 MTS rates.

Resolution T-17542. Mobile Telephony Services surcharge rates to be assessed on the total sales price of prepaid wireless telephone service effective January 1, 2017.

Surcharge rates effective January 1, 2017 adopted per Resolution T-17542.

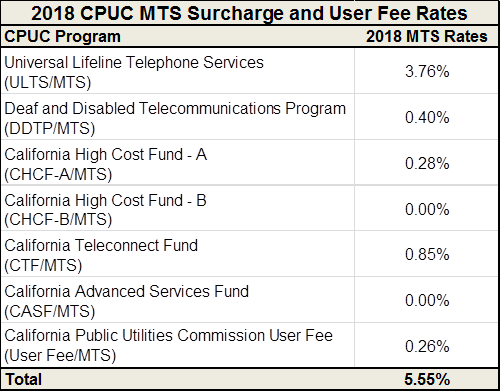

Surcharge rates effective January 1, 2018 adopted per Resolution T-17579

Resolution T-17595, corrects typographical errors in Resolution T-17579

Assembly Bill 1717

For the complete legislation go to:

For a legislative analysis of the bill:

Legislative Memo: April 10, 2014

For more information on the CPUC’s Public Program surcharges go to:

For information from the Board of Equalization

For more information about the 911 emergency telephone users surcharge rate, see Senate Bill 1211, Chapter 926, amendments to section 41030 of the Revenue and Taxation Code.

For questions email: TelcoSurcharge@cpuc.ca.gov