Charging Infrastructure Deployment and Incentives

Funding Cycle Zero

As defined via D.22-11-040, Funding Cycle Zero (FC0) represents the current array of approved TE investments, programs, pending applications and advice letters, and forthcoming near-term priority programs. These programs span the initial light-duty pilots the CPUC authorized in 2016, to all the programs and pilots authorized since the passage of Senate Bill (SB) 350 (De Leon, 2015). Per D.22-11-040, those FC0 programs that are still under implementation will wind down no later than December 31, 2026. This will allow a grace period between when these programs are fully complete and when the Funding Cycle 1 (FC1) programs begin at the start of 2025.

Light-Duty EV Charging Infrastructure Programs---2016 Pilots and Extension Programs

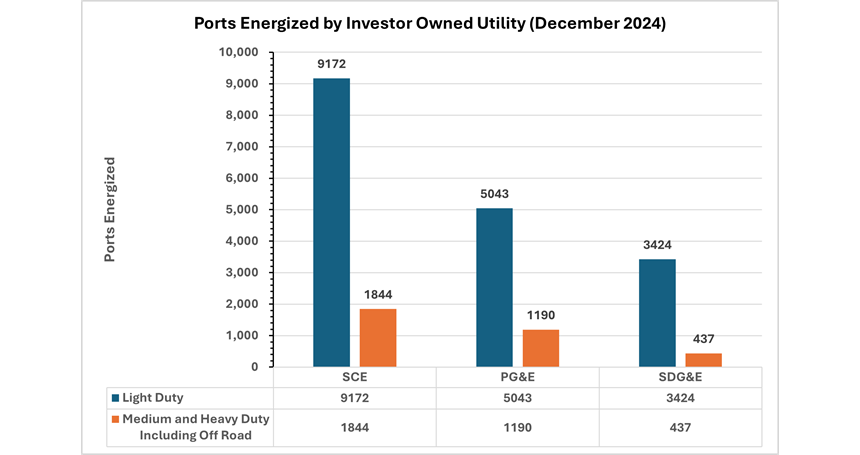

The three large IOUs – PG&E, SCE, and SDG&E – filed applications in 2014 for pilots to install light-duty, mostly Level 2, EV charging stations at workplaces, multi-unit dwellings, and some destination centers. The CPUC approved the IOUs’ pilots in 2016, and all three IOUs have completed implementing these pilots.

- SCE Charge Ready: 2,745 Level 2 charge ports

- SDG&E Power Your Drive: 3,040 Level 2 charge ports

- PG&E EV Charge Network: 4,749 Level 2 charge ports

The CPUC has also authorized SCE, SDG&E, and PG&E to extend their light-duty pilots through SCE’s Charge Ready 2, SDG&E’s Power Your Drive Extension, and PG&E’s Electric Vehicle Charge 2.

- SCE Charge Ready 2 (or Charge Ready Light Duty): In August 2020, the CPUC authorized SCE to spend up to $436 million to fund approximately 37,800 EV chargers. The majority of funds are going toward building Level 2 make-ready infrastructure at apartments, workplaces, and some destination centers. Additional funds are going towards allowing SCE to own the make-ready and charging station at apartments in disadvantaged communities, toward direct current fast chargers (DCFCs), toward Level 2 charging at apartments under construction, and marketing, education, and outreach programs. SCE launched the program in mid-2021.

- SDG&E Power Your Drive Extension: In July 2021, the CPUC authorized SDG&E to spend up to $43.5 million to build at least 2,000 Level 2 chargers at apartments, sites serving apartment dwellers, and workplaces. SDG&E launched the program in mid-2022.

- PG&E EV Charge 2: In December 2022, the CPUC authorized PG&E to spend up to $52.2 million to implement its EV Charge 2 program. The program will run from 2023 through 2026, and will provide support for the installation of approximately 2,822 Level 2 and DCFC ports at apartments, workplaces, and public destination sites. PG&E has not yet launched this program.

2018 SB 350 Standard Review Programs

In May 2018, the CPUC authorized $738 million in IOU infrastructure investments pursuant to SB 350. PG&E and SCE are authorized to spend $210 million and $343 million, respectively, to install infrastructure to support medium- and heavy-duty EVs such as semi-trucks, transit and school buses, fleet delivery trucks, and port equipment through PG&E’s EV Fleet program and SCE’s Charge Ready Transport program. In 2019, the CPUC additionally authorized SDG&E to spend approximately $107 million to support the installation of charging infrastructure for medium- and heavy duty EVs through its Power Your Drive for Fleets program.

PG&E is also authorized to spend up to $22.4 million to install infrastructure for 234 DCFC ports through its EV Fast Charge program. Additional information on the programs approved pursuant to SB 350 can be found here.

2018 SB 350 Priority Review Programs and Small IOU Programs

In January 2018, the CPUC approved 12 new IOU-run infrastructure pilots pursuant to SB 350 with budgets totaling $43 million. Many of these pilots focus on deploying charging infrastructure for medium- and heavy-duty EVs. The IOUs have since completed implementation of these pilots, submitting a final evaluation report describing key findings and challenges, which you can access here.

The CPUC additionally authorized PG&E to spend up to $4 million to establish a program, Empower EV, to provide rebates to low- and moderate-income residential customers that install Level 2 charging stations at home, as well as upgrade electrical panels if necessary. PG&E plans to begin implementing this program in 2023.

For the small IOUs, the CPUC authorized the three smaller IOUs to spend approximately $7.3 million on TE programs related to infrastructure deployment. You can find a summary of those programs and budgets here.

Light-Duty Schools and Parks EV Charging Programs (AB 1082, AB 1083)

Assembly Bills (AB) 1082 and 1083 (Burke, 2017) allowed the electric IOUs to file applications to support charging infrastructure at schools and state parks and beaches, respectively. Pursuant to these bills, in 2019 the CPUC approved a total of $54.5 million for PG&E, SCE, SDG&E, and Liberty Utilities to install up to 800 charging ports at parks, beaches, and schools. The four IOUs began implementing the pilots in 2021. The IOUs are s-

till actively implementing these programs.

- SCE: Charge Ready Schools and Charge Ready Parks Pilot

- SDG&E: Power Your Drive for Schools, Parks and Beaches

- PG&E: EV Charge Schools and Parks

- Liberty Utilities: School/State Park Charging Program

Near-Term Priorities Decision

In July 2021, the CPUC approved D.21-07-028, which identified five near-term priority investment areas--TE resiliency, customers without access to home charging, medium- and heavy-duty electrification, new construction, and Level 2 charging and panel upgrades for low-income customers. The purpose of these was to identify areas for the IOUs to focus their TE investments prior to the adoption of the TEF proposal, which ultimately resolved via D.22-11-040. The near-term priorities decision established an expedited advice letter review process for any associated proposals the IOUs’ file in these priority investment areas. An IOUs’ near-term priority proposal must be capped at $20 million per program and $80 million per IOU, and must have an implementation duration of no longer than three years.

In D.22-11-040, the CPUC established May 31, 2023 as a deadline for the submittal of any near-term priorities advice letters. As of December 2022, only SDG&E has submitted a near-term priority advice letter, which the CPUC is currently evaluating.

Funding Cycle 1

Funding Cycle 1, 2025-2029

Per the latest CPUC TE decision—TE Policy and Investment decision, or the TEF decision—the CPUC set forth a path to shift away from the current ad hoc and disparate program approach to IOU funding for TE. This shift begins in earnest at the start of 2025 with the launch of Funding Cycle 1, or FC1. For the first three years of FC1, the CPUC has authorized the six IOUs to spend up to $600 million, with the potential to access up to $1 billion for the full duration of FC1. The investments in FC1 will focus on light-, medium-, and heavy-duty rebates for behind-the-meter make-readies and chargers; marketing, education, and outreach; and utility-run technical assistance programs.

Non-Ratepayer Funded Investments

CPUC/NRG Settlement

In 2012, the Federal Energy Regulatory Commission (FERC) approved an agreement between NRG Energy and the CPUC to settle outstanding legal issues regarding the 2001 California Energy Crisis. The settlement required NRG to invest $102.5 million in EV charging infrastructure across the state. As a result of this settlement, NRG, via EVgo, installed more than 545 public DCFCs at more than 250 locations, as well as nearly 6,800 make-readies to support Level 2 and Level 1 charging at apartments, workplaces, and public locations. The settlement also included funding for technology demonstrations related to EV charging, and support for EV programs that benefit underserved communities.

Lists of the settlement’s public charging stations and make-ready installations are available at these links.

As of January 2020, the NRG Settlement is complete. Reports, including annual reports and audit reports, as well as further details on the NRG Settlement and its requirements are available here.

Low Carbon Fuel Standard (LCFS) Credit Revenue Programs

EV drivers generate LCFS credits by using low carbon fuel (electricity), and the IOUs receive credits on behalf of their customers. When the IOUs sell the credits, they can return the value of the revenue to benefit current or future EV drivers through rebates or on-bill credits, effectively lowering a driver’s cost to purchase or operate the EV. Rebate amounts have varied over time and across IOU territories based on programmatic changes to how the IOUs return the value of LCFS credit revenue and on the number of LCFS credits generated in each IOU service territory and the price the IOUs can charge for the LCFS credits they are selling.

More information on the IOU programs funded with LCFS credit revenue and the CPUC’s collaboration with CARB to implement these programs is available here.