California Industry Assistance

California Industry Assistance

What is the California Industry Assistance Credit?

The California Industry Assistance Credit is an annual credit for eligible industrial facilities that are customers of the investor-owned electric utilities. The CPUC created this credit program, calculates the credit amount, and oversees the utilities' distribution of the credits to their customers.

The credit is part of California's greenhouse gas reduction program. It is designed to reward businesses that have taken early action to reduce their energy use and greenhouse gas emissions, and to help prevent emissions increases.

This webpage provides informational updates, background, and responses to Frequently Asked Questions (FAQs). For formal and complete information, refer to the specific policies, rules, and formulas that were developed in December 2014 in CPUC Decision (D.)14-12-037 as modified by D.15-08-006, D.16-07-007, and D.21-08-026.

What is the purpose of the California Industry Assistance Credit?

The credit is part of California's greenhouse gas reduction program. The CPUC created the California Industry Assistance Credit as part of its implementation of California's Cap-and-Trade Program to help ensure that emissions leakage does not occur. Emissions leakage occurs when emissions decrease within California but increase outside of California as a result of the Cap-and-Trade Program. Emissions leakage could occur if a production facility moved out of California to a jurisdiction without a Cap-and-Trade Program or other climate goals. This credit protects eligible industrial sectors against emissions leakage by compensating them for a portion of the GHG emission costs associated with the electricity they buy.

Additionally, the California Industry Assistance Credit incentivizes energy and GHG reductions. It is designed to reward businesses that have taken early action to reduce their energy use and greenhouse gas emissions, and to help prevent emissions increases. The amount of the credit is determined by the CPUC for each facility using emissions-efficiency benchmarks that provide an incentive to make products in California in the most energy-efficient way possible.

Who is eligible for Industry Assistance?

One of the basic eligibility requirements is that facilities need to be operating in an industry that is "emissions-intensive and trade-exposed" (EITE). Businesses in EITE industrial sectors face a higher risk of emissions leakage. That is why they are eligible to receive this credit. Any size business can receive the credit.

Another basic requirement is that facilities must be current customers of one of California's investor-owned electric utilities: PG&E, SCE, SDG&E, Liberty Utilities (CalPeco Electric), Bear Valley Electric Service, or Pacific Power (PacifiCorp).

There are two ways the CPUC identifies eligible EITE facilities:

- Facilities that are eligible because they report to CARB.

Eligible EITE facilities that report to CARB (California Air Resources Board) under its Regulation for the Mandatory Reporting of Greenhouse Gas Emissions (MRR) are eligible for CPUC's Industry Assistance Credit. The CPUC and CARB work together to identify these facilities, and the CPUC works with the utilities to deliver the credit. - Facilities that must submit an eligibility claim.

Eligible EITE facilities that do not report to CARB under its MRR, but that operate in the same eligible EITE sectors, can submit a claim (called an attestation form) to verify their eligibility.

If your facility reports to CARB under MRR you do not need to submit an eligibility claim, although your utility will contact you to identify which service account the credit should be applied to. You can contact your utility to find out more about your eligibility status.

If you think you're eligible, but you don't already report to CARB under MRR, read the instructions below about the attestation process.

Attestation Process for Eligible EITE Facilities with Emissions below 10,000 MTCO2e/year

If you believe your facility is eligible to receive California Industry Assistance and you do not already report to CARB under its Regulation for the Mandatory Reporting of Greenhouse Gas Emissions (MRR), you must complete an eligibility claim, or attestation form, to receive California Industry Assistance. The main purpose of the attestation process is to show that your facility operates in an eligible industry. The annual schedule for attestation is below.

California Industry Assistance Schedule from Resolution E-4716

|

Date |

Action |

|

September 30 |

Attestation form submission deadline |

|

November 30 |

Utilities complete review and verification of attestation forms and provide eligible facility data to Energy Division |

|

January 31 |

Energy Division calculates credit due to each eligible facility (identified by September 30 of the previous year) and provides information to utilities |

|

April 1 |

Utilities begin issuing California Industry Assistance as a bill credit to eligible facilities |

Attestation Forms

When the attestation period is open, attestation forms are available from your respective utility using the following links:

- Pacific Gas and Electric Company (PG&E)

- Southern California Edison Company (SCE)

- San Diego Gas & Electric Company (SDG&E)

Customers of Liberty Utilities (CalPeco Electric), Pacific Power (PacifiCorp), and Bear Valley Electric Service should contact their utility directly if they believe they are eligible for California Industry Assistance.

The attestation process is completed at the facility level, where facility is defined in CARB's Cap-and-Trade Regulation Section 95802(144)(A) as ". . . physical property, plant, building, structure, source, or stationary equipment located on one or more contiguous or adjacent properties…" If a business has multiple eligible facilities, it must complete a separate attestation for each facility.

All attestation forms are subject to a random audit to ensure program integrity.

If you would like to see a sample attestation form before your IOU portal opens to see what types of information you may need to gather, an example is in Appendix B of Resolution E-4716 available here.

Attestation Timing

Facilities have the opportunity to attest to their eligibility before September 30 each year. If the facility is eligible, it will receive the credit the next year. If eligible facilities that have received the credit wish to continue receiving California Industry assistance, the facility must re-attest before the start of each compliance period (typically every three years).

CARB Compliance Periods

January 1 - December 31 of the years

| 1st | 2nd | 3rd | 4th | 5th | 6th | 7th |

| 2013-2014 |

2015-2017 |

2018-2020 |

2021-2023 |

2024-2026 |

2027-2029 |

2030-2032 |

Credit Timing and Size

Eligible industrial facilities will receive the California Industry Assistance Credit once per year, either on their electricity bill or as a credit from their utility. Normal credit distribution occurs each year in April. The credit is expected to continue through April 2030, although this may change.

The amount of the credit is determined through the use of emissions efficiency benchmarks, which rewards businesses that have taken early action to reduce GHG emissions. This approach will also ensure that, in the future, these industries have a strong incentive to produce products in California in the most GHG-efficient way possible.

The amount of the credit is calculated for each facility by the CPUC. Utilities do not calculate the credit; they only deliver it on the CPUC's behalf. Credits are calculated using confidential business information which the CPUC protects from disclosure. For more information about how credits are calculated, see Appendix A of D.16-07-007. Updates some formulas and to the Dollar Conversion Factor and GHG Intensity Factor were made in D.21-08-026.

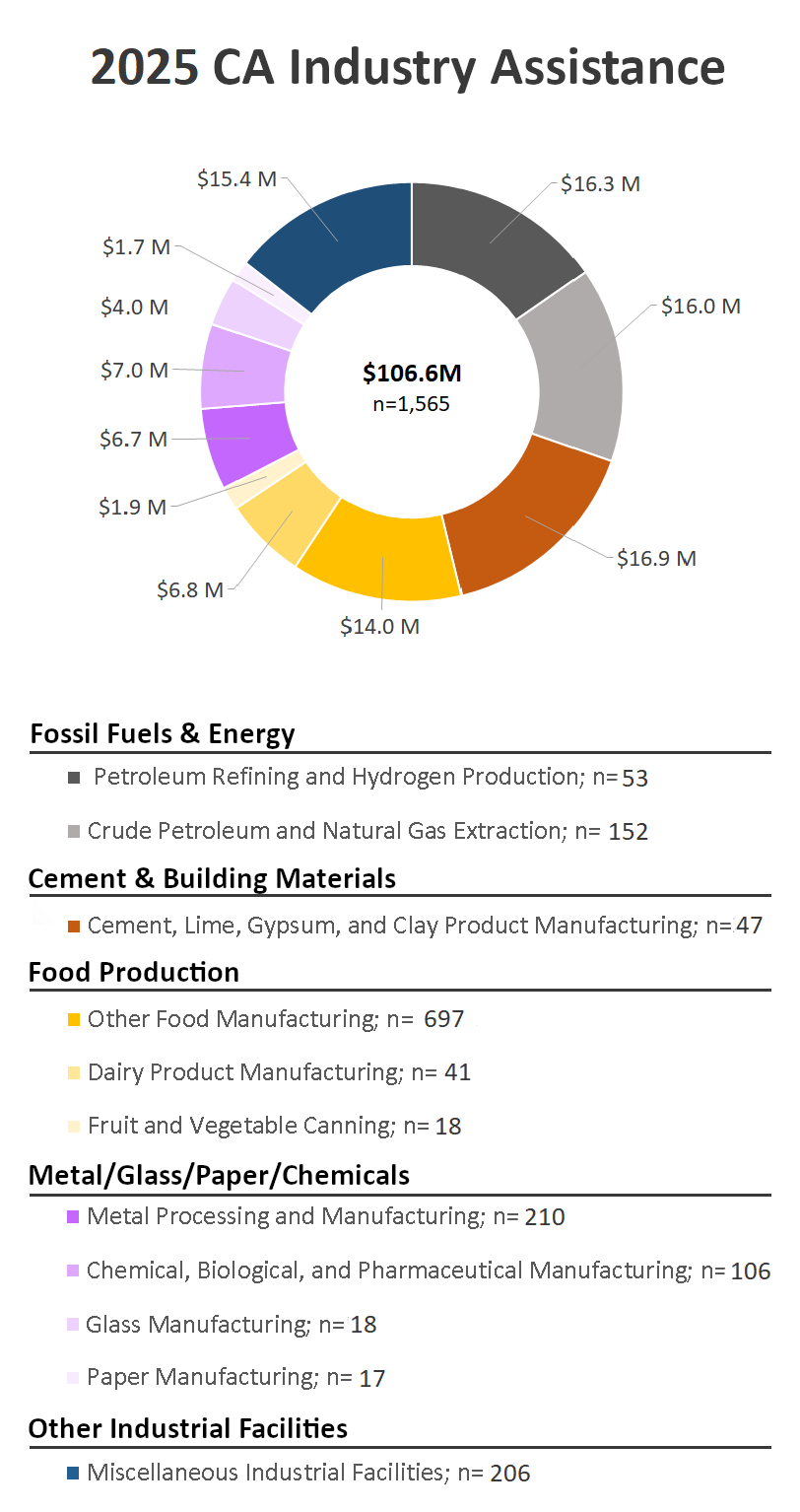

2025 CA Industry Assistance by Sector

To protect confidentiality, each wedge represents multiple facilities and covers multiple NAICS codes. The number of facilities is indicated by the “n=” number in the legend. NAICS codes included in each wedge are adapted from the California Air Resources Board (CARB) reporting available here.

|

|

2023 |

2024 |

2025 | |||

|

|

Assistance ($) |

Number (n) |

Assistance ($) |

Number (n) |

Assistance ($) | Number (n) |

|

Petroleum Refining and Hydrogen Production |

$25.1 M |

65 |

$22.9 M |

51 |

$16.3 M | 53 |

|

Crude Petroleum and Natural Gas Extraction |

$13.6 M |

68 |

$15.8M |

159 |

$16.0 M | 152 |

|

Cement, Lime, Gypsum, and Clay Product Manufacturing |

$17.4 M |

36 |

$17.4 M |

40 |

$16.9 M | 47 |

|

Other Food Manufacturing |

$9.7 M |

866 |

$8.1 M |

425 |

$14.0 M | 697 |

|

Dairy Product Manufacturing |

$6.7 M |

53 |

$6.1 M |

34 |

$6.8 M | 41 |

|

Fruit and Vegetable Canning |

$1.2 M |

23 |

$1.1 M |

20 |

$1.9 M | 18 |

|

Metal Processing and Manufacturing |

$7.1 M |

142 |

$6.4 M |

156 |

$6.7 M | 210 |

|

Chemical, Biological, and Pharmaceutical Manufacturing |

$3.9 M |

55 |

$4.2 M |

58 |

$7.0 M | 106 |

|

Glass Manufacturing |

$4.3 M |

9 |

$4.1 M |

11 |

$4.0 M | 18 |

|

Paper Manufacturing |

$1.5 M |

11 |

$1.7 M |

16 |

$1.7 M | 17 |

|

Miscellaneous Industrial Facilities |

$12.8 M |

186 |

$13.8 M |

178 |

$15.4 M | 206 |

|

|

$103.4 M |

1,514 |

$101.6 M |

1,148 |

$106.6 M | 1,565 |

CA Industry Assistance by Utility

|

|

2022 |

2023 |

2024 |

2025 |

|

|

Assistance ($) |

Assistance ($) |

Assistance ($) |

Assistance ($) |

|

PG&E |

$35.1 M |

$44.3 M |

$41.7 M |

$47.1 M |

|

SCE |

$40.1 M |

$58.3 M |

$57.5 M |

$56.1 M |

|

SDG&E |

$0.5 M |

$0.7 M |

$2.5 M |

$3.4 M |

|

|

$75.7 M |

$103.4 M |

$101.6 M |

$106.6M |

*Note: Customers of Bear Valley Electric Service, Liberty Utilities, and Pacific Power are eligible for CA Industry Assistance. However, currently no facilities served by these IOUs have been identified or attested. Please contact industry.assistance@cpuc.ca.gov if you are customer of one of these utilities and would like additional information.

Additional information on historic total CA Industry Assistance can be found here.

Factors Used to Calculate CA Industry Assistance

Dollar Conversion Factor

The Dollar Conversion Factor is an estimate used when calculating CA Industry Assistance to convert a ton of GHG-equivalent emissions into $USD. Per D.21-08-026, the Dollar Conversion Factor is defined as the average of CAISO’s daily Greenhouse Gas Allowance Index Price for the preceding year plus eight percent. Per D.21-08-026, Energy Division posts this number online:

| Year | Dollar Conversion Factor ($/MT of CO2e) |

| 2017 | $14.57 |

| 2018 | $15.31 |

| 2019 | $17.27 |

| 2020 | $17.17 |

| 2021 | $23.15 |

| 2022 | $25.00 |

| 2023 | $31.83 |

| 2024 |

$36.79 |

| 2025 | $41.14 |

| 2026 | $32.28 |

Based on data from http://oasis.caiso.com/mrioasis/logon.do

Prices>Index Prices>Greenhouse Gas Index Prices

Emissions Intensity Factor

The Emissions Intensity Factor is an estimate used when calculating CA Industry Assistance of the emissions associated with a megawatt hour of electricity. Per D.21-08-026, Energy Division posts this number online:

| PG&E | SCE | SDG&E | Offsite CHP | Unspecified | |

| Pre-2022 | 0.291 | 0.379 | 0.379 | 0.431 | 0.379 |

| 2022 | 0.188 | 0.278 | 0.308 | 0.431 | 0.379 |

| 2023 | 0.181 | 0.270 | 0.300 | 0.431 | 0.379 |

| 2024 | 0.178 | 0.262 | 0.292 | 0.431 | 0.379 |

| 2025 | 0.227 | 0.254 | 0.284 | 0.431 | 0.379 |

| 2026 | 0.243 | 0.250 | 0.280 | 0.431 | 0.379 |

Numbers in MTCO2e/MWh

Cap Adjustment Factor

This factor is specified in the CARB Cap-and-Trade regulation and accounts for annual decline in the total number of allowances issued.:

| Year | Cap Adjustment Factor |

|

| Most NAICS Codes | NAICS Codes 324199 (coke calcining only), 325311, 327310, and 327410 | |

| 2022 | 0.783 | 0.892 |

| 2023 | 0.749 | 0.875 |

| 2024 | 0.715 | 0.858 |

| 2025 | 0.681 | 0.841 |

| 2026 | 0.647 | 0.824 |

From Table 9-2 of the CARB Cap-and-Trade Regulation

Contact

While you can always contact the CPUC if you have concerns or questions, we suggest you try your utility first. That is because your utility can directly access your individual records, tell you whether you're receiving the credit, and correct any errors directly.

If you have questions about CA Industry Assistance, email industry.assistance@cpuc.ca.gov.

California Industry Assistance FAQs

Who is eligible for Industry Assistance?

Entities that primarily operate in industrial sectors that qualify for California Industry Assistance under CARB's Cap-and-Trade Regulation, regardless of the amount of emissions produced, are eligible for California Industry Assistance. A facility is eligible if its principal source of revenue comes from a product, activity, or service that is eligible.

Eligible industries are listed by 2007 North American Industry Classification System (NAICS) Code in Table 8-1 of CARB's Regulation. See the current list of EITE-eligible NAICS codes here.

Facilities must be customers of Pacific Gas and Electric Company (PG&E), Southern California Edison Company (SCE), San Diego Gas & Electric Company (SDG&E), Liberty Utilities (CalPeco Electric) LLC, Pacific Power (PacifiCorp), or Bear Valley Electric Service.

When do I receive my California Industry Assistance?

Most facilities will receive their credit in April each year.

How much assistance will I receive?

The CPUC Energy Division will calculate the level of California Industry Assistance for each eligible facility. The amount of the credit is determined through the use of emissions efficiency benchmarks, which reward businesses that have taken early action to reduce GHG emissions. This approach will also ensure that, in the future, these industries have a strong incentive to produce products in California in the most greenhouse gas-efficient way possible.

If your facility is not a covered entity in the Cap-and-Trade Program, you will receive a credit amount that is based on a benchmark of your historical electricity use.

If your facility is a covered entity, you will receive assistance either based on a benchmark of your historical electricity use or based on the efficiency and level of your production.

To learn more about how the CPUC calculates your credit, please read D.16-07-007 and review the formulas in Appendix A of this decision. Updates to some formulas and to the Dollar Conversion Factor and GHG Intensity Factor were made in D.21-08-026.

Will I get a bill credit or check?

By default, eligible facilities will receive California Industry Assistance as an electricity bill credit.

Only covered entities under the Cap-and-Trade Program may request a check instead of a bill credit. If you're eligible to request a check, your utility will contact you.

All customers receiving California Industry Assistance have the option to "cash out" any remaining bill credit by requesting a check from the utility, if their credit amount exceeds their total bill amount.

What is the attestation process?

The attestation process applies to industrial facilities that want to demonstrate that they are eligible to receive California Industry Assistance. These facilities do not report to CARB under MRR and must sign an attestation form to demonstrate to the CPUC that they primarily operate in an industrial sector that qualifies for California Industry Assistance.

What is a facility?

For the purposes of the California Industry Assistance Credit, a facility is described in CARB's Cap-and-Trade Regulation as "any physical property, plant, building, structure, source, or stationary equipment located on one or more contiguous or adjacent properties in actual physical contact or separated solely by a public roadway or other public right-of-way and under common ownership or common control, that emits or may emit any greenhouse gas…"

For the full definition please refer to Section 95802(a)(144) of the Cap-and-Trade Regulation.