CPUC Telephone Surcharges Reporting and Payment Filing Directions

Notice

Pursuant to D.22-10-021, effective April 1, 2023, all telephone corporations (carriers) operating in California shall assess, collect, and remit California’s Public Purpose Program surcharges pursuant to the access line flat rate surcharge mechanism. This new surcharge mechanism will assess surcharges based on the number of active access lines for telephone services in California. Effective April 1, 2023, all telephone corporations are required to report their access line data as defined in Section 5.2.2 of D.22-10-021. See below for more information.

All telephone corporations (including wireline, wireless, and Interconnected Voice over Internet Protocol (VoIP)) offering telephone service to the public in California, who are authorized by the California Public Utilities Commission (CPUC) to operate in California, are required to assess surcharges on their end-users, and to remit the collected funds as established in Pub. Util. Code §§ 285 and in D.22-10-021.

I. Who must assess and collect telecommunications surcharges?

All telephone corporations including wireline, wireless, and those providing service through Interconnected VoIP1, that sell telephone service to the public are required to assess and collect surcharges from end users, and to remit these surcharges to the CPUC. These surcharges fund the CPUC public purpose programs.

Since January 1, 2019, the directions described on this page apply to ALL telecommunications services – including intrastate prepaid wireless services that were previously subject to the Prepaid MTS Act.

II. What is the new access line flat rate surcharge mechanism?

The Commission adopted the access line flat rate surcharge mechanism in D.22-10-021. This new surcharge mechanism will assess surcharges based on the number of active access lines for telephone corporation services in California. Effective April 1, 2023, all telephone corporations are required to report their access line data as defined in Section 5.2.2 of D.22-10-021 and shown in Section III below.

The user fee shall continue to be assessed and collected based on intrastate telecommunications revenues until the Commission examines this issue further in Phase 2 of R.21-03-002.

III. What is the definition of access line?

In Section 5.2.2 of D.22-10-021, the CPUC defines the following terms:

“Access Line” means a wire or wireless connection that provides a real time two way voice telecommunications service or VoIP service to or from any device utilized by an end user, regardless of technology, which is associated with a 10-digit NPA-NXX number or other unique identifier and a service address or Place of Primary Use in California.

“Telecommunications” has the same meaning as in 47 U.S.C. Section 153(50): “The term ‘telecommunications’ means the transmission, between or among points specified by the user, of information of the user’s choosing, without change in the form or content of the information as sent and received.”

“VoIP service” means service as defined in Pub. Util. Code Section 239.

“Service address” means the physical address in California where fixed telecommunication service is provided.

“Place of primary use” is defined (a) for mobile telecommunications service in Pub. Util. Code Section 247.1(c)(6); and (b) for interconnected VoIP service providers in Pub. Util Code Section 285(d).

Additional Guidelines:

For purposes of this definition, private branch exchange (PBX) lines and Centrex lines are “access lines.” The number of access lines a carrier provides to an end user shall be deemed equal to the number of inbound or outbound two-way communications by any technology that the end user can maintain at the same time as provisioned by the carrier’s service.

IV. What programs are funded through the CPUC’s Public Purpose Program Surcharge(s)?

The CPUC’s Public Purpose Program surcharge(s) support the following six public purpose programs:

- California High Cost Fund A (CHCF-A)

- California High Cost Fund B (CHCF-B)

- California Universal Lifeline Telephone Service (LifeLine or ULTS)

- California Teleconnect Fund (CTF)

- Deaf & Disabled Telecommunication Program (DDTP)

- California Advanced Services Funds (CASF)

Prior to April 2023, the CPUC required telephone corporations to assess, collect, and remit six separate Public Purpose Program surcharges, one surcharge for each of the above listed programs. However, beginning April 2023, there will be a single Public Purpose Program surcharge that will fund all six programs.

V. What are the current surcharge rates?

Current and historical CPUC surcharge rates can be found at: Surcharges, Fees & Taxes

VI. How is the public purpose program surcharge collected from end-user customers?

A surcharge should be collected from each end-user that has an access line. See Surcharges, Fees & Taxes for the current surcharge amount. LifeLine subscribers and incarcerated individuals are exempt from the Public Purpose Program surcharges and user fees. Telephone corporations must disclose and itemize Public Purpose Program on customer bills, invoices or receipts, pursuant to Revenue and Taxation Code Section 42010 (3) (i).

VII. How are the CPUC surcharges reported and remitted?

The CPUC requires all telephone corporations, including VoIP providers offering telephone service to the public, to report the number of access lines online using the Telecommunications & User Fees Filing System (TUFFS), and remit the owed funds through a link to the California State Agency Electronic Funds Transfer (EFT) System. The TUFFS website allows any carrier, whether postpaid or pre-paid, to report the number of access lines and remit surcharges in a user friendly fashion. Once a carrier has reported the total number of access lines for a given month, the system then calculates the total surcharge amount due. Telephone corporations must then remit the total surcharge amount due via the payment portal Automated Clearing House ‑ACH‑ debit, through the Electronic Funds Transfer ‑EFT‑ system.

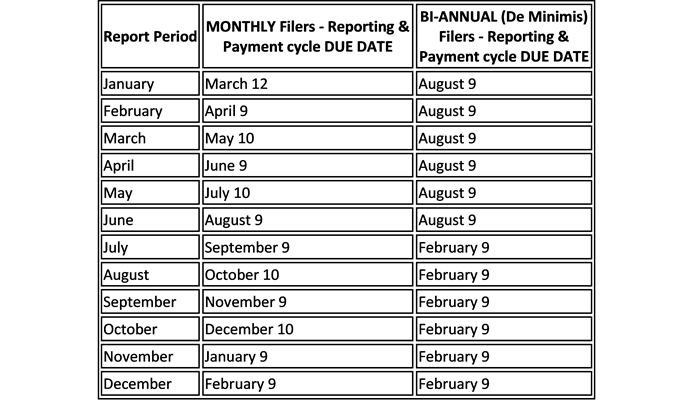

All certificated and registered telephone corporations must report and remit surcharges on a monthly basis, except for those that bill a de minimis amount of surcharges (the de minimis rule). The de minimis rule permits a carrier to report and remit all surcharges semi-annually for each month of a six-month period. The de minimis periods are January through June and from July through December.

The de minimis rule applies to telephone corporations whose average intrastate service revenues subject to surcharge are equal to or less than $10,000 a month. Carriers that meet this criteria and wish to report and remit surcharges semi-annually may send an e-mail to telco_surcharge@cpuc.ca.gov including: the carrier’s legal name, the four-digit utility identification number assigned by the CPUC, and a statement to the fact that the average intrastate service revenues subject to surcharge are equal to or less than $10,000 per month. Although de minimis carriers are only required to report and remit payments twice a year, telephone corporations must still report the number of access lines for each month during the six-month period. Qualified carriers may change to de minimis after reporting for the month of June or December. The de minimis period would start with January-June or July-December.

Please note that all carriers are required to report the number of access lines and remit resulting surcharges even when total access lines subject to surcharge are zero.

In the event that the total intrastate revenues subject to surcharge exceed $60,000 for telephone corporations reporting under the de minimis rule, telephone corporations must advise the CPUC and begin to file monthly. It is the telephone corporations’ responsibility to be aware that the frequency of its reporting obligation has changed and to notify the CPUC of this change from semi-annually to monthly.

Additional instructions regarding how to use the online system to report and remit payments may be found in the TUFFS and EFT payment system user guides.

IIX. When should surcharge be reported and remitted?

Surcharge funds must be reported and remitted no later than 40 days following the close of a reporting period (See table below). Carriers that report and/or remit surcharge funds after the due date will be charged a penalty equal to an annual rate of 10%. The penalty funds will be assessed on the surcharge amount due, including any adjustments, starting from the 41st day after the close of the reporting period to the date that the carrier reports or surcharge monies are remitted, whichever is later.

IX. What are the compliance requirements and what enforcement mechanisms are available to the CPUC?

All reporting and payments are subject to audit verification by the CPUC or CPUC designee(s). As such, carriers are expected to maintain data for at least five (5) calendar years, unless specifically authorized otherwise by a CPUC order or a director’s letter. Pursuant to Resolution T-17601, the CPUC will issue a citation to telephone corporations that fail to properly report and remit surcharge payments for at least six months. Additionally, those telephone corporations may be subject to administrative or judicial collection actions and/or revocation of their authority to operate in California.

X. Reporting Periods Prior to April 2023

For reporting periods prior to April 2023, telephone corporations must report and remit surcharges based on the total intrastate revenue. For April 2023 and all following reporting periods, telephone corporations must remit surcharges on a per access line basis. User fees will continue to be assessed on total intrastate revenue until further notice.

For periods prior to April 2023, telephone corporations should use the Legacy TUFFS. The process is the same as described in Section VII above (for periods after April 2023), except the telephone corporation will enter its amount of aggregate intrastate revenues subject to surcharge into TUFFS. The legacy system then calculates the surcharge amount due for each of the six surcharge funds. Payment is then made by Automated Clearing House (ACH) debit through the EFT system for each surcharge fund.

Additional instructions for using Legacy TUFFS can be found here.

“Intrastate” means a telecommunications service that originates and terminates within California. Generally, services subject to tariff (or formerly tariffed) with the CPUC are subject to California surcharges, whereas interstate services, taxes and surcharges, and financial charges and fees, are not. Intrastate services that are subject to surcharges include, but are not limited to, residential or business lines; wireline services; pre and postpaid wireless services and any associated services, including, but not limited to:

- Custom calling features (such as Caller ID, Voice Store and Forward, Call waiting);

- Private line service;

- 800/900 service; and

- Non-recurring charges (such as installation and connection charges)

Carriers must assess surcharges on all of their revenues for intrastate telecommunications services except for the following:

- California LifeLine service revenue;

- Charges to other certificated carriers for services that are to be resold;

- Coin-sent paid telephone calls (coin in box) and debit card calls;

- Customer-specific contracts effective before 9/15/94;

- Usage charges for coin-operated pay telephones;

- Directory advertising; and

- One-way radio paging.

The CPUC does not prescribe one methodology to determine intrastate revenues subject to Universal Service program surcharges. Telephone Corporations, including VoIP providers, that are required to assess universal service surcharges on intrastate telephone service revenues from end-user customers may use any of the methods below to determine the intrastate revenues. Examples of reasonable methods to determine intrastate revenues include, but are not limited to:

- FCC Safe Harbor Percentage – Carriers may apply California revenues using the inverse of the Federal Interstate Safe Harbor Percentage adopted by the Federal Communications Commission (FCC) to fund federal universal service programs for the respective type of carrier.

- Traffic Study- A carrier may develop a jurisdictional allocation through a Traffic Study factor, representing the average usage patterns of the carrier’s own customers, and then apply this to their California revenues.

- Books and Records- Intrastate revenues subject to the surcharge may be calculated by a service supplier based upon books and records kept in the regular course of business or for other purposes, including nontax purposes.

For Interconnected VoIP providers, the California legislature endorsed three methods of determining which revenues are subject to intrastate surcharges (see recently enacted AB 841, now codified at PU Code §285(e). In addition to the above two methods, AB 841 provided the additional option of any other “means of accurately apportioning interconnected VoIP services between federal and state jurisdictions.”

- Surcharges are applied to the price that the end-user customer pays for service and not any other lesser amount such the wholesale price that a carrier may get from third party retailers.

- Surcharges are not assessed on equipment cost. It is the carrier’s responsibility to make a reasonable determination of what portion of a charge is for services subject to surcharges when service is bundled with equipment or other services that are not subject to universal service surcharges.

1The Legislature enacted P.U. Code §285 to ensure that Interconnected VoIP service providers collect and remit public purpose program surcharges. A VoIP service is a service, defined in P.U. Code § 239, is one that:

- Enables real-time, two-way voice communications;

- Requires a broadband connection from the user’s location;

- Requires Internet protocol-compatible customer premises equipment (CPE); and

- Permits users generally to receive calls that originate on the public switched telephone network and to terminate calls to the public switched telephone network. (47 CFR § 9.3)